The Fallout 4: Here's Your Sign?

Continued from Part 3

The Nattering One muses... You can check the posts on this site to reference how many times we have Nattered about all these things, ad nauseum ... it sure is nice to get some validation. Meanwhile, Here's Your Sign.... More to come in Part 5.

From David Stockman... The Fed is Not Your Friend.

Well-trained seals and computerized algos populate the Wall Street casino.

This madcap money printing campaign was a drastic error because it failed to account for the immense roadblock to traditional monetary stimulus that had been built up over the last several decades—namely, “peak debt” in the household and business sector.

This condition means that monetary easing and drastic interest rate cuts have not elicited a surge of consumer borrowing and business capital spending and hiring as during past business cycle recoveries.

Instead, the entire tsunami of monetary expansion has flowed into the Wall Street gambling channel, inflating drastically every asset class that could be traded, leveraged or hypothecated.

Stated differently, 68 months of zero interest rates had virtually no impact outside the the canyons of Wall Street.

But inside the casino, they provided virtually free money for the carry trades, causing an endless bid for leveragable and optionable financial assets.

That the credit channel of monetary expansion is busted and done is patently obvious in the data on the household sector.

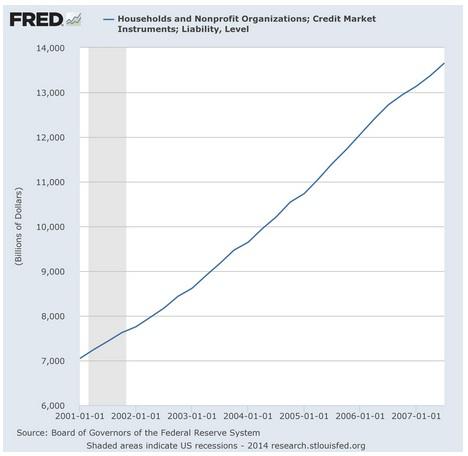

Below is the track of total household debt during the prior Greenspan housing bubble 2001-2007.

During the Greenspan housing and credit bubble, household debt soared by nearly 90%, providing a robust, if temporary, boost to the consumption component of GDP.

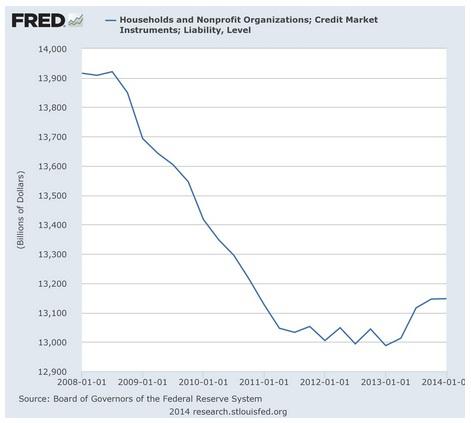

During the 78 months since the last peak, 2008-2014 household credit has shrunk by 5%. Nothing like this has every happened before. Not even remotely close.

The 10,000 baby boomers retiring each and every day between now and 2030 will not be adding to household debt; they will be liquidating it.

What this means is that the motor force of traditional Keynesian expansion is gone.

Household consumption spending, perforce, can now grow no faster than household income and economic production, and likely even more slowly than that.

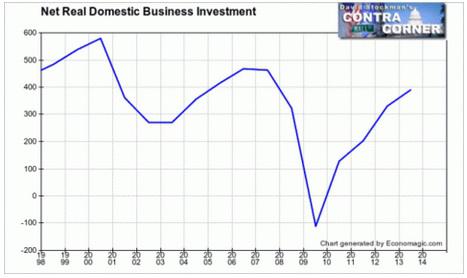

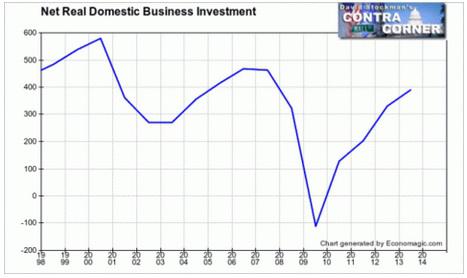

During the most recent quarter, real spending for plant and equipment was still 4% below its late 2007 peak.

Business is not rushing to the barricades to add to capacity because it is plainly evident that consumer demand is not growing at traditional recovery cycle rates; and that it will never again do so given the constraints of peak debt and the baby boom retirement cycle ahead.

In fact, real net investment in CapEx—after allowance for depreciation of assets currently consumed—- is on a declining trend.

Not only does this reflect the drastic downshift in the growth potential of the US economy that has set-in during the era of monetary central planning, but it also underscores that the current stock averages are capitalizing a future that is a pure chimera.

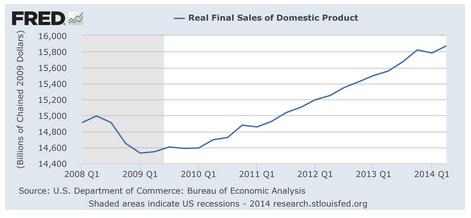

Setting aside the short-run inventory swings which cloud the headline GDP numbers each quarter, and which accounted for nearly half of the 4% gain reported for Q2, real final sales tell the true story.

Notwithstanding the Fed massive balance sheet expansion since its first big rate cut in August 2007—-that is, from $800 billion to $4.4 trillion—–real final sales have grown at less than a 1% CAGR since then.

There is nothing like this tepid rate of trend growth for any comparable period in modern history.

Indeed, given the clear bias toward under-reporting inflation in the BEAs GDP deflators, it is probable that during the last seven years the real economy has grown at a rate not far from zero.

All of this means that the financial markets are drastically over-capitalizing earnings and over-valuing all asset classes.

The Nattering One muses... You can check the posts on this site to reference how many times we have Nattered about all these things, ad nauseum ... it sure is nice to get some validation. Meanwhile, Here's Your Sign.... More to come in Part 5.

Comments