Timing Is Everything? - Part 7

Following up on Timing Is Everything? - Part 6...

To come full circle, our prescient comment from 02 Oct 2018, 08:07 AM...

B for Bob responded...To come full circle, our prescient comment from 02 Oct 2018, 08:07 AM...

Proximo,

Patterns? Waves? Month end, Q end and Golden Week liquidity hoarding did not slow this down much. Or did it just set the stage?

Where? Retro check a DAILY NAS FUTURES current contract chart.

What? Last peak 08/30, prior 07/25, coincidence? Go back at least 18 months, filter out the small chops and measure the drops and duration.

When? Now look at calendar, notice a more or less steady five week duration between major peak dates. See the pattern for what it is, and know that Thurs Oct 4th is coming up.

At the moment 10/01 new peak 7728, since dropping 100 pts. Couple of days chop and sideways flag wave till Thurs? OR this "cycle" may have started three days early after Italian budget, bond, Euro debacle?

R2K may already be tipping the hand? An overall eight trading day drop would put us on Mon. Oct 16th. Sounds like a familiar date to me, TBD. Watch Bonds and the Dollar for signs.

Happy Fishing.

SpaniardRepeating the tail end of our post market rout October 4th Nattering...

Golden week ends Mon Oct 8th, this means China has been out of the party so far, what happens if they have need for liquidity and decide to liquidate

Further damage? if it breaks 7160, then 6950 which is 10% correction zone. Beyond that we shall not comment. TBD.

Never forget, what an investor paid matters not, nor does intrinsic value. Why? because its ALL a CON-fidence game. Emphasis apropos.

Does nobody else read or believe the gospel? Salmo is most wise and generous to share his wealth of knowledge. Thank you my mentor and friend.

Spaniard

"Does nobody else read or believe the gospel?"

I'm certainly trying. Piece by piece. Slow and steady. One day hopefully I can fully grasp it.Salmo Trutta's reponse to our Nattering...

Thanks Spaniard.

It's like Jeffrey Snider said: "One of the most striking aspects of this modern system is how the line between money and credit has blurred; a lot of what might be counted strictly as debt is at the same a monetary instrument (collateral in repo, as one example)."

There’s some distortion in the #s:There wasn't much deviation in the rate-of-change of monetary flow figures until the Treasury Borrowing Advisory Committee’s decision to immediately transfer funds to the Treasury’s General Fund Account at one of the 12 District Reserve Banks. This speciously reduces both the money stock and legal reserve figures.

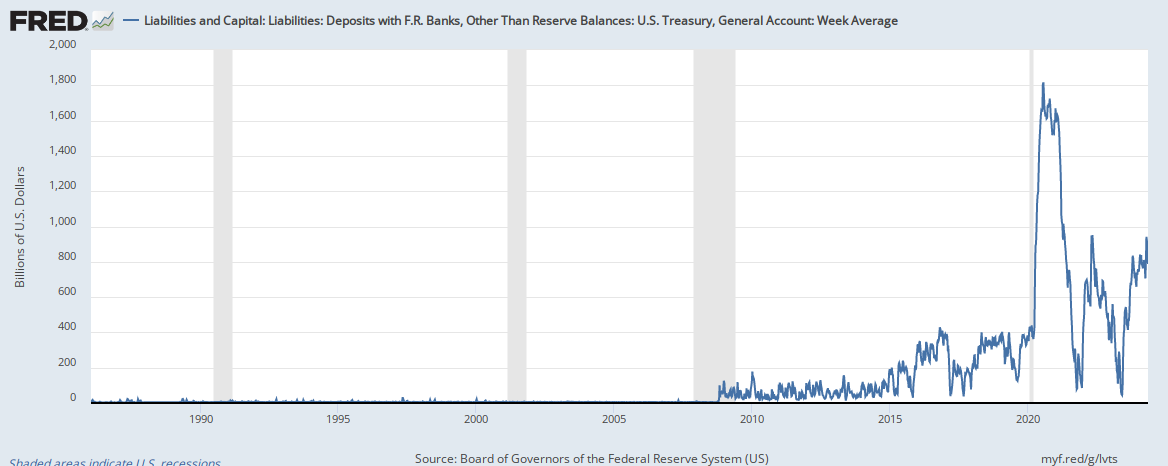

See: DickSinger’ comment: “In the past the Treasury did impact the money stock figure by allowing commercial banks to hold Treasury funds in Treasury Tax and Loan accounts, but since January 3, 2012, funds in these accounts must be transferred to the Fed by the close of business on the day they are received so the end-of-day balance is always zero”Deposits with Federal Reserve Banks, other than Reserve Balances: U.S. Treasury, General Account

Government transfer payments

In retrospect, our full comment from Ruckus Premium? (Quarter End)....

The prescience of your (Salmo's) axiomatic observations will pay those who took the time to understand, and connect the dots, even greater dividend later this year.

Know where the mark is going ahead of time, never chase, wait patiently, when they walk into the crosshairs, squeeze the trigger firmly and terminate with extreme prejudice.

Elephant tracks indeed, and timing is everything. Again, thank you for not spoon feeding, and making me learn the hard way. - The Nattering NaybobAs highlighted in this series, this October has been a wild ride. As suggested in Part 6, are the Little Susie's waking up? And when October is over maybe this? All TBD...

In conclusion, knowing the nature of seasonality in monetary flows, one can identify market patterns and the timing thereof, and having an understanding of such is indispensable.

And at the end of the day, timing is everything.

More to come in Timing Is Everything? Part 8, stay tuned, no flippin.

Ruckus Premium? (Quarter End)

Dark Side Of The Moon?

Dark Side of The Moon? Part 2

Timing Is Everything?

Timing Is Everything? - Part 2

Timing Is Everything? - Part 3

Timing Is Everything? - Part 4

Timing Is Everything? - Part 5

Timing Is Everything? - Part 6

From Salmo Trutta:

The Dark Side Of The Moon: The Seasonal Clock

The Darker Side Of The Moon

Comments