COVID19: The Sound Of Silence?

Picking up where COVID19: Great Gig In The Sky? left off... ingredients in tonight's melodic and lyrical submission: nobody is really listening, inability to communicate, ignorance and willingness to follow a preset regime? Could any of this have something to do with institutional communication, expectation anchoring and action or inaction?

Hello darkness, my old friend

I've come to talk with you again...

We've Nattered about crowded environments, transmission, seasonal flu numbers, mortality rates, imagined vs real, the backdraft of draconian measures, predicted "superspreader" events, pigs in a poke and monetary policy blunders for many reasons. Unlike others, this was not to infer that COVID19 is much ado about nothing...

Since banks pay FDIC deposit fees, they may impose negative deposit rates, which would chase depositors into cash forcing rates lower. Good for the banks, because every dollar deposited will cost them? The outflow of deposits would reduce liquidity and further financial disintermediation? Will the financial welfare happy banksters push rates negative to regain their Fed put? Actions, actions...

What of the $1T in foreign bank (exempt from FDIC fees) parked at the FRB? With the Fed IOER arb gone, why would they issue CP or stay parked? Liquidity impairment? With REPO crippled and CP frozen (the Fed will act today), lower rates and downward pressure help? Could foreign bank reserve deposits find their way to the US banks? Could those flows keep US banks liquid and fund Fed QE? What of MMF's? Any inflows might go to UST purchases, lowering rates further.

So many flows and questions. At the end of the day, downward pressure on rates as backstop liquidity reserves shift into the form of balance sheet tools (UST), potentially financing Fed QE. What of making loans, economic investment or circulating money through the economy? With compressed NIM's and heightened risk, not so much and now this...

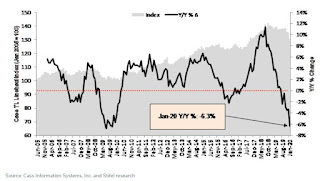

Above, dog piling the weakest airfreight, rail carload and intermodal since 2009, buys one the truckload linehaul index from the CASS Transportation Index Report January 2020 looking like 2009. Over the long and near term horizons one can easily find a veritable plethora of downward trending data. Party like its 1999 or 2009? The axiom applies, as transports go the rest follows. Like COVID19 Moving West...

One minute we have containment, no worry, no problem, robust economy, an ample reserve regime, the next: a declaration of national emergency, and bank bail out with RESERVES and rates cut to zero. Indeed as our institutional leadership has proven beyond a shadow of a doubt, and not just over this last weekend, what they say and do are two different things, and their actions speak louder than words.

This is the mother of all meltdowns and what happened when confronted by the virally expedited results of their prior inaction and actions? In respective Friday and Sunday press conferences the obviously panic stricken wildly, sprayed blanks, and all their bullets, whilst completely missing the target. This is the best we have? and this was their "finest hour"? Seriously folks, if this is as good as it gets, we are in some deep banta poodoo.

As matters worsen, who will be "The Fall Guy" for the resulting fallout? A blanket "To combat the effects of COVID19" should cover the usual suspects and their sponsors tracks, globally. What of John Q, the economy and the public's well anchored expectations as communicated by the FED? The handwriting for economic contraction and capitulation were written on the subway walls, as was speculation of economic consequence to come in these Chronicles halls, and whispered in the sound of economic silence...

"Fools", said I, "You do not know

Silence like a cancer grows"

More to come in COVID19: Parabellum? Stay tuned, no flippin.

Recommended Reading:

2019 nCOV - Pleased To Meet You?

COVID19: Same Bat Time?

COVID19: Same Bat Channel?

COVID19: Secondary Infection?

COVID19: Bat Out Of Hell?

COVID19: Pig In A Poke?

COVID19: Great Gig In The Sky?

CASS Transportation Index Report January 2020

Hello darkness, my old friend

I've come to talk with you again...

We've Nattered about crowded environments, transmission, seasonal flu numbers, mortality rates, imagined vs real, the backdraft of draconian measures, predicted "superspreader" events, pigs in a poke and monetary policy blunders for many reasons. Unlike others, this was not to infer that COVID19 is much ado about nothing...

"At the end of the day, COVID19 could do substantial damage, and yet it sadly remains a secondary viral infection. How so? It is more likely that the talking monkey panic (so far -$6 Trillion) and their knee jerk reactions will create more damage than the virus itself ever could."In tonight's offering for your perusal and anecdotal amusement, a prime example of the above with economic evidence, and a series of Tweet's highlighting the knock on effect of recent (since July 2019) and long term FOMC rate cuts, including 03/03 Super Tuesday's -50bps and the Sunday 03/15 -100bps "surprise emergency" cuts gone viral.

excepting a very brief period at the end of September 2019, [the Fed] have kept IOER (the remuneration rate) above all money market rates (cost of credit) for several years...the amount of money and bank credit supplied to the economy ALSO depends upon behavioral actions of the commercial banks and the public.Dateline Sunday 03/15: the Fed cut FFR -100 to 0.00-0.25, more importantly IOER -100 to 0.10 and RRP -100 to 0.00, and reserve requirements to ZERO. The curve is no longer inverted, and IOER is now BELOW the entire curve albeit barely for some maturities. In addition, with ZERO reserves required ($200B) plus $1.5T in funds currently held as excess reserves, is there economic lending and investment incentive? At the moment banks get a higher rate on UST's, which they are buying, pushing yields down further.

Since banks pay FDIC deposit fees, they may impose negative deposit rates, which would chase depositors into cash forcing rates lower. Good for the banks, because every dollar deposited will cost them? The outflow of deposits would reduce liquidity and further financial disintermediation? Will the financial welfare happy banksters push rates negative to regain their Fed put? Actions, actions...

What of the $1T in foreign bank (exempt from FDIC fees) parked at the FRB? With the Fed IOER arb gone, why would they issue CP or stay parked? Liquidity impairment? With REPO crippled and CP frozen (the Fed will act today), lower rates and downward pressure help? Could foreign bank reserve deposits find their way to the US banks? Could those flows keep US banks liquid and fund Fed QE? What of MMF's? Any inflows might go to UST purchases, lowering rates further.

So many flows and questions. At the end of the day, downward pressure on rates as backstop liquidity reserves shift into the form of balance sheet tools (UST), potentially financing Fed QE. What of making loans, economic investment or circulating money through the economy? With compressed NIM's and heightened risk, not so much and now this...

In an attempt to vaccinate the economy and markets against said virus, the FOMC exhibits a bad case of rate cut fever, which confirms their infection and affliction. Rather than improve the economic situation and other than artificially juicing asset markets, rate cuts have created in order: prolonged financial disintermediation, economic contraction, serial meltdowns (the repo ruckus of late) and multiple liquidity crises including the one in progress. Need more cuts? On with the show...Federal Reserve Board Catches COVID19 Virus!!!!— The Nattering Naybob (@NaybobNattering) March 3, 2020

FFR -50 to 1.00 - 1.25;

IOER -50 to 1.10;

RRP -50 to 1.00#SPX $SPX #ES_F #Dow $NQ #NQ #NDX $RUT #DAX #FTSE $ES_F $YM_F $QQQ $Dow #Equities #Indices #Futures #FX #Commods #COVID19 #Fed #FOMO

Inbound and outbound loaded shipping container data demonstrates economic contraction had been well underway PRE COVID19. Correlation...PRIOR to COVID19... Forget TOTAL, its juiced with EMPTIES. Sept - Jan the key is YOY % delta for LOADED imports -3;-19;-12;-20;-4 and exports -11;-19;-9;-12;+2 #COVID19 @EricLiptonNYThttps://t.co/xycHE6Dctqhttps://t.co/1j9w9ot5OU https://t.co/wuS7woZ3LM— The Nattering Naybob (@NaybobNattering) March 1, 2020

Above and below, further confirmation and triangulation... 03/06 China Exports -17% and shipment volumes dropped 9.4% in January vs 2019 levels (Chart 1), as the index posted its lowest absolute reading in roughly three years. It was also the steepest y/y decline since 2009. Probably not surprisingly, like shipment volumes, freight expenditures also fell, down 8.0% y/y. Even before the coronavirus issues have any impact on the U.S. transportation market, the freight market is weak, partially due to elevated inventories.Look at PRE COVID19 Hong Kong as a proxy for China - Jan MOM delta % Imports -16%; Exports -23% @EricLiptonNYT #COVID19 https://t.co/wuS7woZ3LM— The Nattering Naybob (@NaybobNattering) March 1, 2020

Above, dog piling the weakest airfreight, rail carload and intermodal since 2009, buys one the truckload linehaul index from the CASS Transportation Index Report January 2020 looking like 2009. Over the long and near term horizons one can easily find a veritable plethora of downward trending data. Party like its 1999 or 2009? The axiom applies, as transports go the rest follows. Like COVID19 Moving West...

We don't need no stinkin rate cuts or negative rates... with the entire curve below 2% inflation, we already have negative real rates of interest. The new normal? Cut after cut, necessitating intervention after increased intervention, yielding (pun intended) there is something in this more than natural, and most un-normal as perverse policy blunder after blunder based in false doctrine, and econometric falsity exacts an economic toll. And remember all of the above was BEFORE coronavirus had any impact.Whiskey, Tango, Foxtrot?? This market hasn't been "NORMAL" in over two decades... since central bank low rate and QE policies threw price discovery out with the bath water. https://t.co/BYLuj0YuVG— The Nattering Naybob (@NaybobNattering) March 1, 2020

One minute we have containment, no worry, no problem, robust economy, an ample reserve regime, the next: a declaration of national emergency, and bank bail out with RESERVES and rates cut to zero. Indeed as our institutional leadership has proven beyond a shadow of a doubt, and not just over this last weekend, what they say and do are two different things, and their actions speak louder than words.

This is the mother of all meltdowns and what happened when confronted by the virally expedited results of their prior inaction and actions? In respective Friday and Sunday press conferences the obviously panic stricken wildly, sprayed blanks, and all their bullets, whilst completely missing the target. This is the best we have? and this was their "finest hour"? Seriously folks, if this is as good as it gets, we are in some deep banta poodoo.

As matters worsen, who will be "The Fall Guy" for the resulting fallout? A blanket "To combat the effects of COVID19" should cover the usual suspects and their sponsors tracks, globally. What of John Q, the economy and the public's well anchored expectations as communicated by the FED? The handwriting for economic contraction and capitulation were written on the subway walls, as was speculation of economic consequence to come in these Chronicles halls, and whispered in the sound of economic silence...

"Fools", said I, "You do not know

Silence like a cancer grows"

More to come in COVID19: Parabellum? Stay tuned, no flippin.

Recommended Reading:

2019 nCOV - Pleased To Meet You?

COVID19: Same Bat Time?

COVID19: Same Bat Channel?

COVID19: Secondary Infection?

COVID19: Bat Out Of Hell?

COVID19: Pig In A Poke?

COVID19: Great Gig In The Sky?

CASS Transportation Index Report January 2020

Comments

The ICE U.S. Dollar Index DXY, 0.987%, a measure of the U.S. currency against a basket of six major rivals, traded at 100.47, up 1.4% and at a three-year high

https://www.marketwatch.com/story/why-a-disorderly-us-dollar-surge-is-being-blamed-for-adding-to-market-volatility-and-the-global-stock-selloff-2020-03-18?mod=home-page

Open

Last Updated: Mar 19, 2020 9:50 a.m. EDT

Delayed quote

$

21.79