And The Band Played On?

Continuing from Conundrums: Putting Out A Fire With Gasoline?

If today's title seems familiar, we visited said title in 2008's And The Band Played On and 2014's The Credit Ran Out, And The Band Played On. Also perhaps because of a poignant 1993 TV film of the same name based upon a 1987 non fiction book regarding people, politics and the HIV and AID's epidemic. Alas history repeats?

Thus, what little delta or increased Roc in real money stock we have seen since Nov 2018, cannot be in excess of the true CPI. If it was, we would have a five alarm fire on our hands, and wages would be infuego, a good thing but alas. And now this baby ducks...

Stagflation classic: slow economic growth, rising prices and high unemployment. As has been readily proven in our current long term (decades) economic malaise, advertised unemployment levels if not accompanied by meaningful wage inflation, matter not.

Thus, our current brand of stagflation: economic slowing coupled with a loss of future economic capacity (strangulation), accompanied by rising prices or inflation (exsanguination) and pernicious real wage stagnation (purchasing power erosion), all resulting in a lowered standard of living... and the band played on? Back on track...

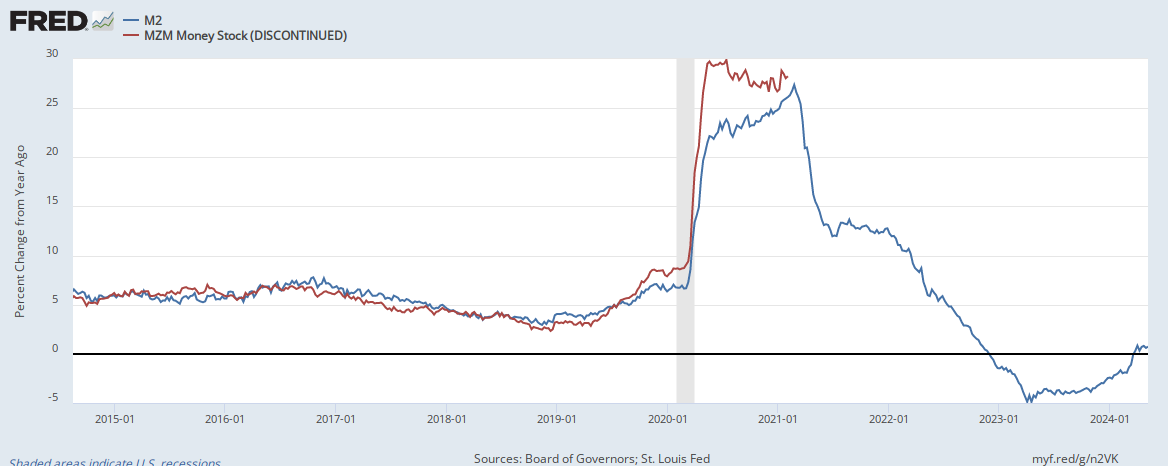

IMHO the minor upswing in YOY ROC for M2, MZM indicates an "all in" on ETF's or John Q borrowing to BTFD, which has juiced MMMF's. More idle gambling, no investment in real endeavor, tsk, tsk.

Confirming my suspicion through triangulation: monetary velocity is still quite dead, the M1 money component and Divisia DM1 and DM2 have collapsed, and since July 2018 the Baltic Dry Index has tanked 66%.

That unholy trinity is anything but bullish for the global economy or our two legged emasculated dog of one (FIRE economy and market speculation.) Negative real GDP, declining future growth expectations, reduced purchasing power, no problem, new highs and the band played on.

More to come in If A Tree Falls? stay tuned, no flippin.

Recommended reading:

Timing Is Everything?

Know Your Limitations?

Parting The Red Sea?

A Little Shop Of Horrors?

Where's Your Messiah?

Rapture?

Ro-BUST?

Beware The Ides Of Winter?

Meddling With Powers?

The Perfect Storm?

Begin The Benign?

A Case of Tape-r Worm?

Beware The Ides of Winter Early?

A Disturbing Lack of Faith?

Canary In A Coal Mine?

FreeTrade Warning?

Global Economy Down?

Wear Sunscreen?

Trust Me On The Sunscreen?

Let Me Warn You?

Lunar New Year For Old Blind Men?

Shutdown Impacts Inflection?

LIBOR: Putting Out A Fire With Gasoline?

A Yen For Liquidity? Or No Yen For Carry?

Interest Rate Swaps: Putting Out A Fire With Gasoline?

Expectations: Putting Out A Fire With Gasoline?

Conundrums: Putting Out A Fire With Gasoline?

If today's title seems familiar, we visited said title in 2008's And The Band Played On and 2014's The Credit Ran Out, And The Band Played On. Also perhaps because of a poignant 1993 TV film of the same name based upon a 1987 non fiction book regarding people, politics and the HIV and AID's epidemic. Alas history repeats?

"The RoC in real money (the growth of the money stock in excess of the CPI), will expand. That is construed as bullish." - Salmo TruttaBullish for equities perhaps, which have not been a reflection of the real economy for quite some time. Many know the CPI as a poster child for falsity in econometrics and thus pegged artificially low. Meanwhile, stagflation rages on.

Thus, what little delta or increased Roc in real money stock we have seen since Nov 2018, cannot be in excess of the true CPI. If it was, we would have a five alarm fire on our hands, and wages would be infuego, a good thing but alas. And now this baby ducks...

Stagflation classic: slow economic growth, rising prices and high unemployment. As has been readily proven in our current long term (decades) economic malaise, advertised unemployment levels if not accompanied by meaningful wage inflation, matter not.

Thus, our current brand of stagflation: economic slowing coupled with a loss of future economic capacity (strangulation), accompanied by rising prices or inflation (exsanguination) and pernicious real wage stagnation (purchasing power erosion), all resulting in a lowered standard of living... and the band played on? Back on track...

IMHO the minor upswing in YOY ROC for M2, MZM indicates an "all in" on ETF's or John Q borrowing to BTFD, which has juiced MMMF's. More idle gambling, no investment in real endeavor, tsk, tsk.

Confirming my suspicion through triangulation: monetary velocity is still quite dead, the M1 money component and Divisia DM1 and DM2 have collapsed, and since July 2018 the Baltic Dry Index has tanked 66%.

That unholy trinity is anything but bullish for the global economy or our two legged emasculated dog of one (FIRE economy and market speculation.) Negative real GDP, declining future growth expectations, reduced purchasing power, no problem, new highs and the band played on.

More to come in If A Tree Falls? stay tuned, no flippin.

Recommended reading:

Timing Is Everything?

Know Your Limitations?

Parting The Red Sea?

A Little Shop Of Horrors?

Where's Your Messiah?

Rapture?

Ro-BUST?

Beware The Ides Of Winter?

Meddling With Powers?

The Perfect Storm?

Begin The Benign?

A Case of Tape-r Worm?

Beware The Ides of Winter Early?

A Disturbing Lack of Faith?

Canary In A Coal Mine?

FreeTrade Warning?

Global Economy Down?

Wear Sunscreen?

Trust Me On The Sunscreen?

Let Me Warn You?

Lunar New Year For Old Blind Men?

Shutdown Impacts Inflection?

LIBOR: Putting Out A Fire With Gasoline?

A Yen For Liquidity? Or No Yen For Carry?

Interest Rate Swaps: Putting Out A Fire With Gasoline?

Expectations: Putting Out A Fire With Gasoline?

Conundrums: Putting Out A Fire With Gasoline?

Comments