Big Trouble in Little China?

Following up on Rinse and Repeat? What happens economically and financially when "oddly" symbiotic trading partners suffer declining growth rates? After growth last year cooled to a near 30-year low...

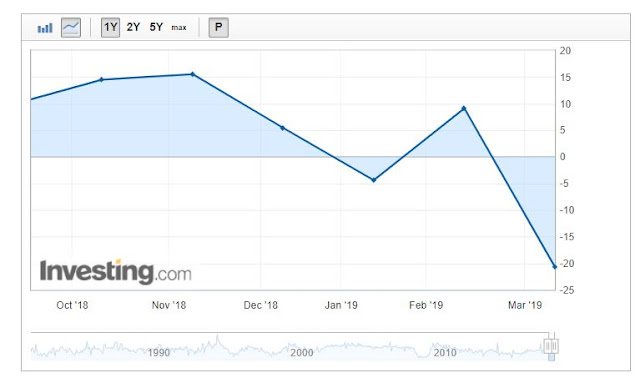

Exports in February tumbling 20.7% Yoy. 22% ($526B) of US imports come from China (19% of Chinese exports = $430B)

Chinese M2 (red) in steady decline and flatlining since late 2017. M1 (yellow) tanking since mid 2016. Some interesting graphics pertaining to China's economy.

More to come in Chinese Take Out? Stay tuned, no flippin.

Recommended reading:

Timing Is Everything?

Know Your Limitations?

Parting The Red Sea?

A Little Shop Of Horrors?

Where's Your Messiah?

Rapture?

Ro-BUST?

Beware The Ides Of Winter?

Meddling With Powers?

The Perfect Storm?

Begin The Benign?

A Case of Tape-r Worm?

Beware The Ides of Winter Early?

A Disturbing Lack of Faith?

Canary In A Coal Mine?

FreeTrade Warning?

Global Economy Down?

Wear Sunscreen?

Trust Me On The Sunscreen?

Let Me Warn You?

Lunar New Year For Old Blind Men?

Shutdown Impacts Inflection?

LIBOR: Putting Out A Fire With Gasoline?

A Yen For Liquidity? Or No Yen For Carry?

Interest Rate Swaps: Putting Out A Fire With Gasoline?

Expectations: Putting Out A Fire With Gasoline?

Conundrums: Putting Out A Fire With Gasoline?

And The Band Played On?

If A Tree Falls?

Pay No Attention?

Rinse and Repeat?

Factory activity in China contracted to a three-year low in February as export orders fell at the fastest pace since the global financial crisis.

The official Purchasing Managers’ Index (PMI) fell to 49.2 in February, pointing to a contraction in activity for the third straight month. "The weakening trend may not end quickly,” Iris Pang, Greater China economist at ING, said in a note. “As such we expect March’s PMI to fall, too.”

Manufacturing output contracted in February for the first time since January 2009, during the depths of the global crisis. New export orders shrank for a ninth straight month, and at a sharper rate, in the latest sign of deteriorating global demand.

In a sign of the wider impact China’s shrinking demand is having globally, factory output in Japan, the world’s third-largest economy, posted its biggest decline in a year in January. That followed data out last week that showed Japan’s exports logged their worst drop in more than two years as China-bound shipments tumbled.Chinese Imports declining 5% Yoy. 9.2% ($154B) of Chinese imports come from the US (8.6% of US exports = $130B).

Some economists believe China’s economic growth could even dip below 6 percent in the first half — from 6.4 percent in the fourth quarter.

Record lending by Chinese banks in January and a sharp rebound in its stock markets have lifted some of the gloom... analysts say it will take months to see if the strong credit impulse translates into improved business activity, assuming companies are borrowing for fresh expansion or investment, not merely refinancing existing debt.

Manufacturers continued to cut jobs more aggressively... the pace of job-shedding was the fastest since December 2015. Business owners and labor activists have told Reuters that companies have shut earlier than usual... with some likely to close for good. - ReutersPremier Li Keqiang said the nation must be prepared for a "tough struggle" as it faces a "grave and more complicated environment." Li cut the country's economic growth target this year to 6.0%-6.5%, lower than the GDP growth of 6.6% in 2018, the slowest pace since 1990.

Chinese M2 (red) in steady decline and flatlining since late 2017. M1 (yellow) tanking since mid 2016. Some interesting graphics pertaining to China's economy.

More to come in Chinese Take Out? Stay tuned, no flippin.

Recommended reading:

Timing Is Everything?

Know Your Limitations?

Parting The Red Sea?

A Little Shop Of Horrors?

Where's Your Messiah?

Rapture?

Ro-BUST?

Beware The Ides Of Winter?

Meddling With Powers?

The Perfect Storm?

Begin The Benign?

A Case of Tape-r Worm?

Beware The Ides of Winter Early?

A Disturbing Lack of Faith?

Canary In A Coal Mine?

FreeTrade Warning?

Global Economy Down?

Wear Sunscreen?

Trust Me On The Sunscreen?

Let Me Warn You?

Lunar New Year For Old Blind Men?

Shutdown Impacts Inflection?

LIBOR: Putting Out A Fire With Gasoline?

A Yen For Liquidity? Or No Yen For Carry?

Interest Rate Swaps: Putting Out A Fire With Gasoline?

Expectations: Putting Out A Fire With Gasoline?

Conundrums: Putting Out A Fire With Gasoline?

And The Band Played On?

If A Tree Falls?

Pay No Attention?

Rinse and Repeat?

Comments